The M&IE rate is based on these meal costs plus an additional amount, equal to 10% of the combined lodging and meal costs, to cover incidental travel expenses.

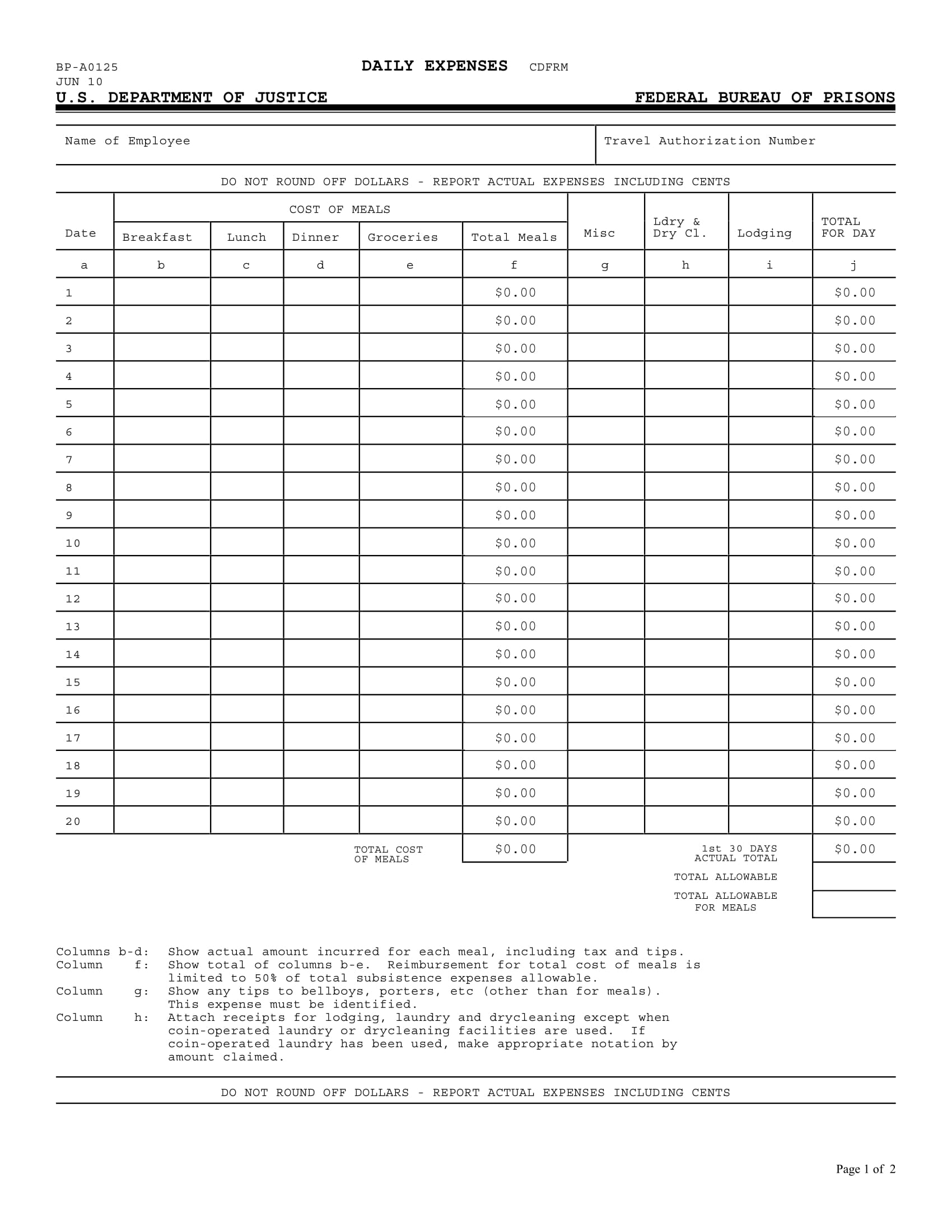

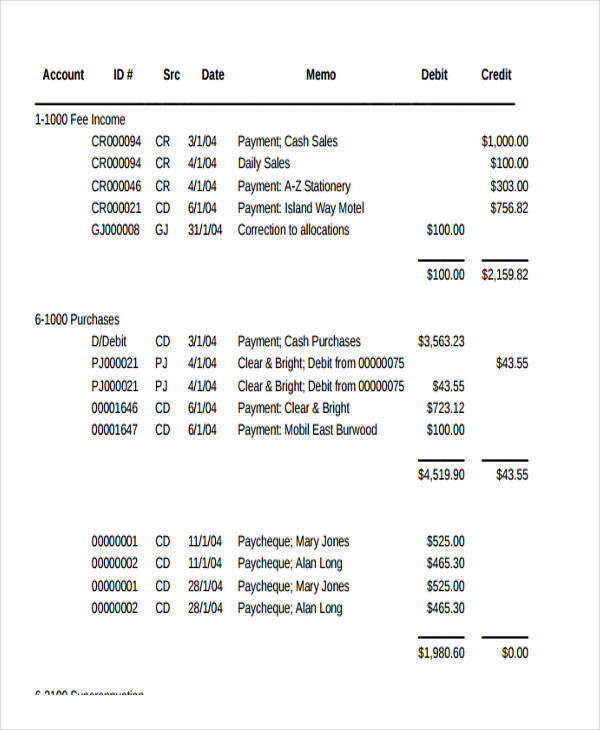

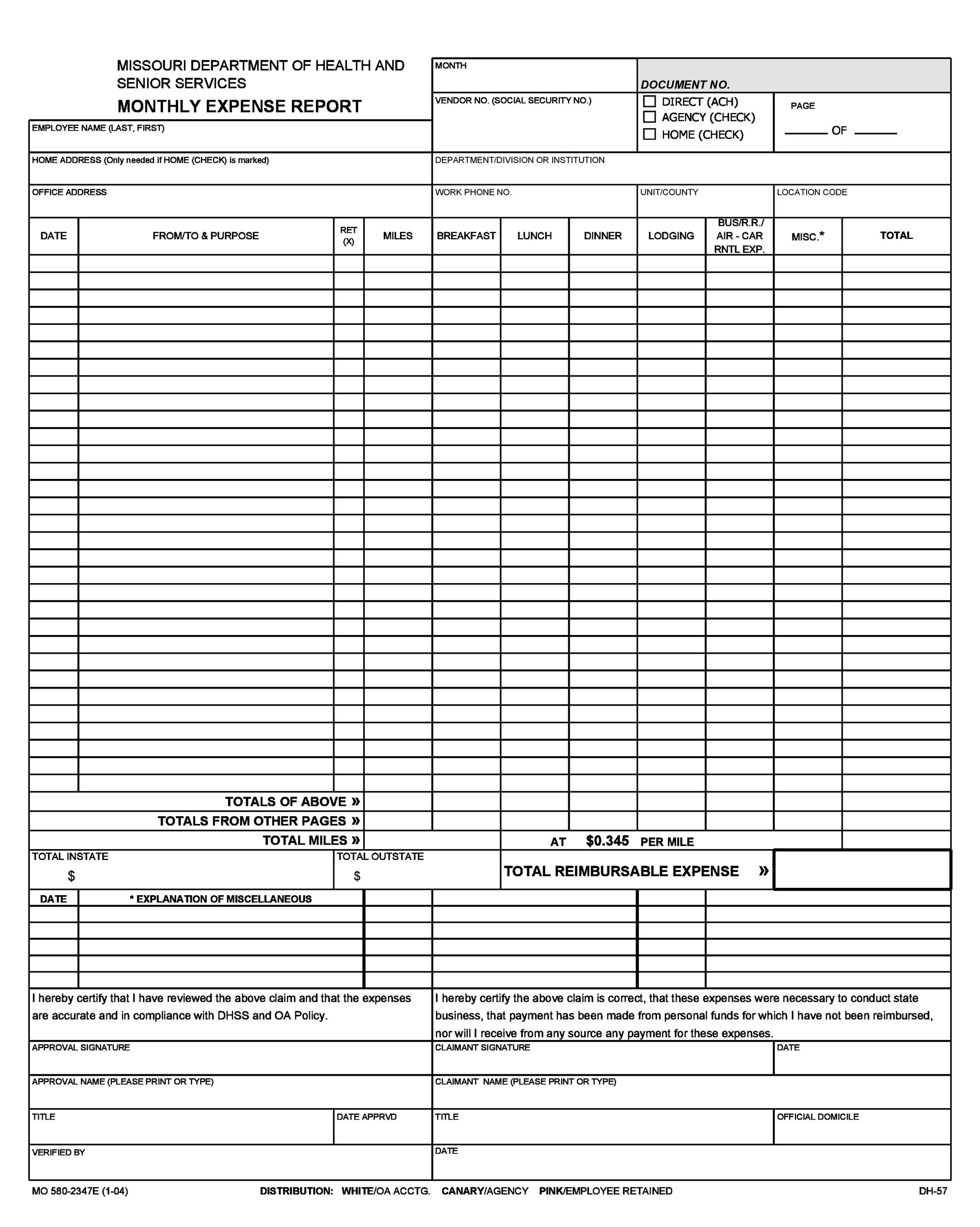

The meal portion is based on the costs of an average breakfast, lunch, and dinner at facilities typically used by employees at that location, including taxes, service charges, and customary tips. The lodging portion of the allowance is based on average reported costs for a single room, including any mandatory service charges and taxes. This report includes prices for hotel rooms and meals at facilities representative of moderately priced and suitable hotels and restaurants most frequently used by typical Federal travelers. The maximum per diem rates for foreign countries are based on costs reported in the Hotel and Restaurant Survey (Form DS-2026) submitted by U.S. The M&IE portion is intended to substantially cover the cost of meals and incidental travel expenses such as laundry and dry cleaning. The maximum lodging amount is intended to substantially cover the cost of lodging at adequate, suitable and moderately-priced facilities. Separate amounts are established for lodging and meals plus incidental travel expenses (M&IE). They should also seek information on the possible avoidance of taxes or their refund upon return to the United States or their post of assignment. Government employees when arranging for hotel reservations.

If you have questions regarding the per diem rates, please contact the Office of Allowances.Į-mail: travelers are advised to request information on hotel discounts for U.S. An unlisted suburb of a listed location takes the "Other" rate, not that of the location of which it is a suburb. NOTE: Any location not listed for per diem under a country takes the "Other" rate we administer and publish for that country. Any further clarification of the area covered by a specific listing is contained in associated footnotes which can be viewed by selecting Foreign Per Diems By Location. When a political subdivision smaller than a country is named, such as states, provinces, departments, cities, towns, villages, etc., it will include the corporate limits of such political subdivision or the limits of territory within the normal boundary thereof if it is not incorporated. In such cases, no cost data pertinent to such territories and possessions were used in determining the established rates. It will not include territories or possessions located elsewhere even though considered an integral part of the parent country or island.

Where a country or island is listed it is intended to include all territory within the boundaries of that country or island including any off-shore islands in the same general vicinity. The Chapter 925 Per Diem Supplement to the Standardized Regulations (Government Civilians, Foreign Areas) lists all foreign areas alphabetically. The Bureau of Public Affairs of the Department of State offers a subscription service that permits individuals to receive notices when Foreign Travel Per Diem rates are updated. 14) Defense Agencies - see the JTR for members of the uniformed services as well as for civilians.)

#Daily expenses report manual#

(Foreign Affairs Agencies - see Foreign Affairs Manual ( FAM) (Vol. For regulations pertaining to these rates, see the Federal Travel Regulation (FTR) established by the General Services Administration and implementing regulations established by Federal Agencies. The breakdown of rates by meals and incidentals is found in Appendix B. Lodging and M&IE (Meals & Incidental Expenses) are reported separately followed by a combined daily rate. Government civilians traveling on official business in foreign areas. Foreign Per Diem rates are established monthly by the Office of Allowances as maximum U.S.

0 kommentar(er)

0 kommentar(er)